U.S. Government imposes tax on U.S. residents on the basis of their worldwide income. It includes a citizen who is born in the United States or outside with one parent who is a U.S. citizen, a naturalized citizen, a resident of the United States for tax purposes if they meet the green card test or the substantial present test for the calendar year, any other person who is not a foreign person. The rules of U.S. citizenship are complex and if you are born as a U.S. citizen or considered as the one under U.S. nationality law is subject to tax unless you renounce your citizenship. It is not necessary that you need to have an American passport.

If you are born outside the U.S. and have dual citizenship and never lived in America, you will be considered a U.S. person for tax purposes and you still have to report and pay U.S. taxes till you terminate your U.S. citizenship. Green card holders and tax residents are subject to U.S. taxation on their worldwide income. If your green card has expired, after moving back to the country of origin and you have not formally cancelled your U.S. immigration status, you still have to file your U.S. tax returns. Even if you are not in the U.S. anymore, as a green card holder, you must remember that your tax responsibilities do not change until you surrender the card or there has been a final administrative or judicial determination to revoke or abandon it.

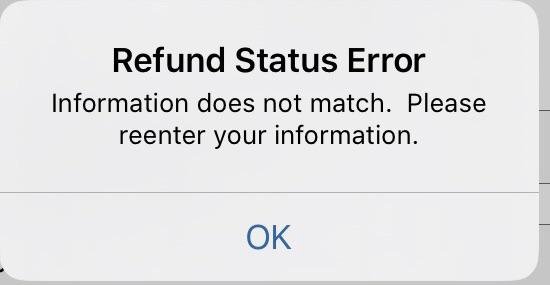

You can now easily pay your taxes online although recently some errors have been reported by users. Users said that the IRS website shows that their information does not match when they go to look up their refund they filed a few days ago and it says that it accepted their return. A user said that his system showed that return was accepted but suddenly the next day it showed that the information entered was incorrect and unavailable. Another user said that he claimed EIC and stimulus payments for a child born in 2020. It was accepted but from the next morning it was showing the “information doesn’t match” error everyday. If you are also experiencing the same issue while checking your refund at the IRS website, you can follow these steps to fix the issue by yourself –

- Re-check the e-file status at https://shop.turbotax.intuit.com/efile/efilestatuslookup.jsp.

- Ensure that you enter the federal refund amount without the state refund, less than TurboTax fees if you choose to pay any fee out of the refund.

- If you are filing jointly, use the Social Security Number for the name that first appears on the return.

- If you have already tried the above-mentioned steps on the IRS website, check the status of your refund by calling IRS Refund Hotline at 800-829-1954.